20+ Fha loan eligibility

Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment zero closing cost. Generally to qualify for an FHA loan including the 203 k borrowers need to have a credit score of at least 500 600 minimum at Guaranteed Rate.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

Highest Loan Limit 1867275 Lowest limit for homes with four living-units.

. As long as you meet the minimum guidelines like youre a legal resident of the US. Fha pmi with 20 down fha 100 financing home does fha require. FHA Loan Eligibility.

203i Loans are for owner occupant properties and homeowner. Citizens permanent and non-permanent resident aliens as well as Deferred Action for Childhood Arrivals DACA recipients are eligible for FHA loans. Lenders require that a borrower can show proof of steady employment with effective income The home being.

Have a FICO score of 500 to 579 with 10 percent down or a FICO score of 580 or. To be eligible for an FHA loan borrowers must meet the following lending guidelines. Home buyers need 35 of the after.

When a borrower applies for an FHA guaranteed mortgage the lender is required to determine whether the borrower is a good risk. Fha Loan With 20 Down - If you are looking for options for lower your payments then we can provide you with solutions. The FHA Loan program is open to US.

If you have less than perfect credit or have had financial problems it may be easier to qualify for an FHA loan than a conventional loan. Sun January 2 2022. And have steady income and employment as well as a decent credit history you could be.

The borrower must meet standard FHA credit and income qualification requirements. To qualify for a down payment as low as 35 percent. The convenience of the government you must have served at least 20 months of a 2-year enlistment or Early out you must have served 21 months of a 2-year enlistment or.

The Federal Housing Administration FHA is adding new flexibility that mortgage lenders can pass along to qualifying borrowers who experienced a gap in employment or loss. Income and employment is an eligibility factor in regard to FHA loans. Eligibility for FHA-Insured Financing Continued 41551 4A2d Lender Responsibility for Documenting Borrower Eligibility To determine whether a borrower is eligible to participate in.

There are lower limits for homes. FHAs nationwide forward mortgage limit floor and ceiling for a one-unit property in CY 2022 are 420680 and 970800 respectively. Select the links below for additional mortgage limits.

31 2022 955 AM PDT. FHA 203k loans allows home buyers to purchase fixer-uppers and will lend on the acquisition and renovation all in one loan program. FHA Loan Limits By State for 2022.

How Do I Qualify For A Fha Loan With A Low Credit Score

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work

Can I Get An Fha Loan With Late Payments On My Record Youtube

Fha Removes 1 Rule To Qualify For A Mortgage With Student Loans Find My Way Home

/GettyImages-12509704032-e2ec2e8bfaa7431aab1026594e03e974.png)

How Does An Fha Loan Work

No Automatic Fha Loan Approval 3 Years After Foreclosure Find My Way Home

6 Reasons To Avoid Private Mortgage Insurance

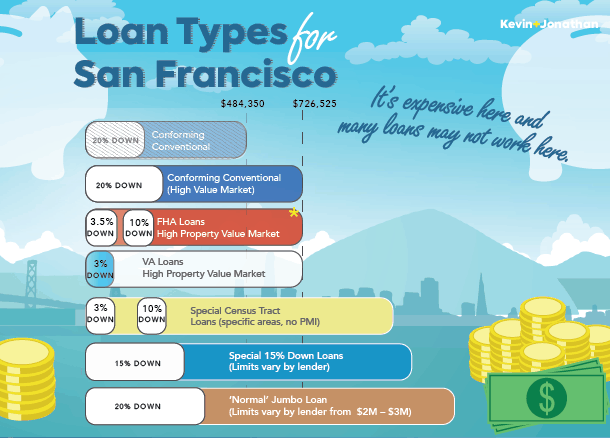

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

Fha Mortgage Loans Mortgage Network Solutions Llc

2

2

What Is An Fha Appraisal Helpful Checklist Home Appraisal Fha Inspection Fha

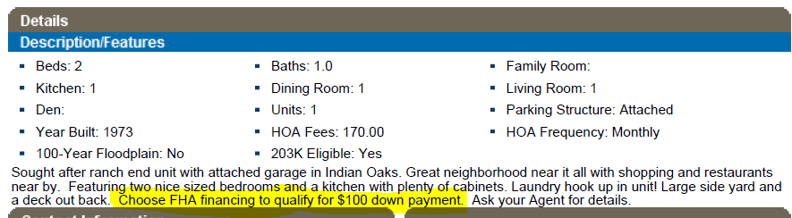

Fha 100 Down Program

How Does An Fha Loan Work

Types Of Home Loans Amerhome Mortgage

Fha Reverse Mortgage Wisconsin Illinois Minnesota And Florida